are federal campaign contributions tax deductible

You cannot deduct contributions made to a political candidate a campaign committee or a newsletter fund. Data on individual contributors includes the following.

Are Political Contributions Tax Deductible Turbotax Tax Tips Videos

There will be a.

. You cannot deduct contributions made to a political candidate a campaign committee or a newsletter fund. Federal political contributions are donations that were made to a registered federal political party or a candidate for election to the House of Commons. Donors who are eligible to itemize charitable contributions on income tax returns may include contributions made through the CFC.

For people that want to donate money to a political campaign it is essential to think if one can deduct it from your tax return. Many believe this rumor to be true but contrary to popular belief the answer is no. Can I deduct my contributions to the Combined Federal Campaign CFC.

Many charitable contributions are eligible for deduction from your federal and state adjusted gross income. Yes you can deduct them as a Charitable Donation if you file Schedule A. Likewise gifts and contributions to 501 c 4 social welfare organizations are not deductible as charitable contributions.

Can You Deduct Political Contributions From Your Taxes. The Federal Election Campaign Act amendments of 1974 set specific limits for campaign contributions. However for 2021 individuals who do not itemize their deductions may deduct up to 300 600 for married individuals filing joint returns from gross income for their qualified cash charitable contributions to public charities private.

Wrongfully claiming political contributions can and will attract the attention of the Internal Revenue Service and can lead to an assessment of additional taxes due penalties and interest. Generally you can only deduct charitable contributions if you itemize deductions on Schedule A Form 1040 Itemized Deductions. Your tax deductible donations support thousands of worthy causes.

You can claim a credit for the amount of contributions that you or your spouse or common-law partner made in the year to a registered federal political party a registered association or a candidate in a federal election. A federal contribution can be claimed by either spouse or common-law partner but one contribution receipt cannot be split between spousesIf you have a spouse and want to contribute more than 400 in one year it would be beneficial to make two separate contributions for greater flexibility in maximizing the tax credit. This doesnt just mean that donations made to candidates and campaigns are excluded from being tax deductible.

According to the Internal Service Review IRS The IRS Publication 529 states. The answer is no as Uncle Sam specifies that funds contributed to the. According to the IRS the answer is a very clear NO.

You can receive up to 75 percent of your first 400 of donation as credit followed by 50 percent of any amount between 400 and 750 and 333 percent of amounts over 750. The IRS makes it clear that you cannot deduct contributions that you make to any organizations that arent qualified to receive tax-deductible donations. The CFC is comprised of 30 zones throughout the United States and overseas.

This means that if you donate to a political candidate a political party a campaign committee or a political action committee PAC these. You cannot deduct contributions made to a political candidate a campaign committee or a newsletter fund. Campaign contributions and special gifts.

Contributions that exceed that amount can carry over to the next tax year. Donors should contact a tax advisor for more information. Are my donations tax deductible.

While inside the software and working on your return type charitable donation in the Search at the top of the screen you may see a magnifying glass there. Individuals may deduct qualified contributions of up to 100 percent of their adjusted gross income. It also extends to political action committees PACs.

The tax rate for amounts over 750 is 33. Political donations to federal candidates and committees are not deductible from federal income taxes whether they are made online or in person. Many believe this rumor to be true but contrary to popular belief the answer is no.

However donations to ActBlue Charities and other registered 501 c 3. If you received or expect to receive any advantage for making a contribution the eligible amount you can claim is the amount of the fair market value of your. For contributions to be honored as an official contribution the receipt must reside with you.

To qualify the contribution must be. The following are examples of the various types of contributor searches that may be conducted. Governor lieutenant governor secretary of state auditor of state treasurer of state attorney.

Advertisements in convention bulletins and admissions to dinners or programs that benefit a political party or political candidate are not deductible it says in IRS Publication 529. Federal law does not allow for charitable donations through payroll deduction CFC or any other payroll deduction program to be done pre-tax. The IRS which has clear rules about what is and is not tax-deductible notes that any contributions donations or payments to political organizations are not tax-deductible.

Are Political Contributions Tax Deductible. According to the Internal Service Review IRS The IRS Publication 529 states. Thank you for contributing through the Combined Federal Campaign CFC.

A 75 tax deduction may be claimed for 400 contributed a 50 rate for any contribution that is 400 or more and a 33 rate for each contribution that is 400 or more. It doesnt matter if it is an individual business or other organization making the donation the campaign contribution is not deductible. A corporation may deduct qualified contributions of up to 25 percent of its taxable income.

The Commission maintains a database of individuals who have made contributions to federally registered political committees. How to get to the area to enter your donations. Each of these zones has.

Contributions or gifts to Candidate Committees are not deductible as charitable contributions for federal income tax purposes but Ohio taxpayers may claim a state tax credit for contributions made to political campaign committees of candidates for. Search an individual contributor by their.

Are Political Contributions Tax Deductible Smart Asset

Are Political Contributions Tax Deductible Smart Asset

Why Political Contributions Are Not Tax Deductible

Are Political Contributions Tax Deductible Personal Capital

Tax Stock Photos Images Pictures Business Tax Deductions Income Tax Return Income Tax

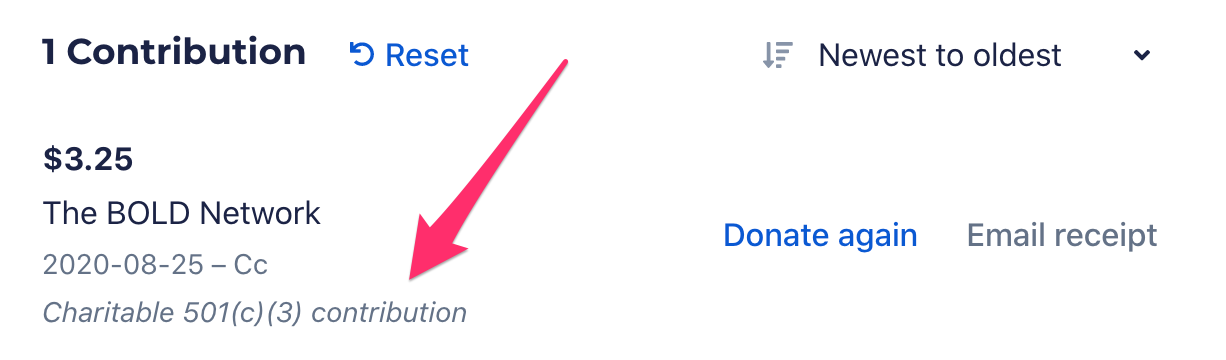

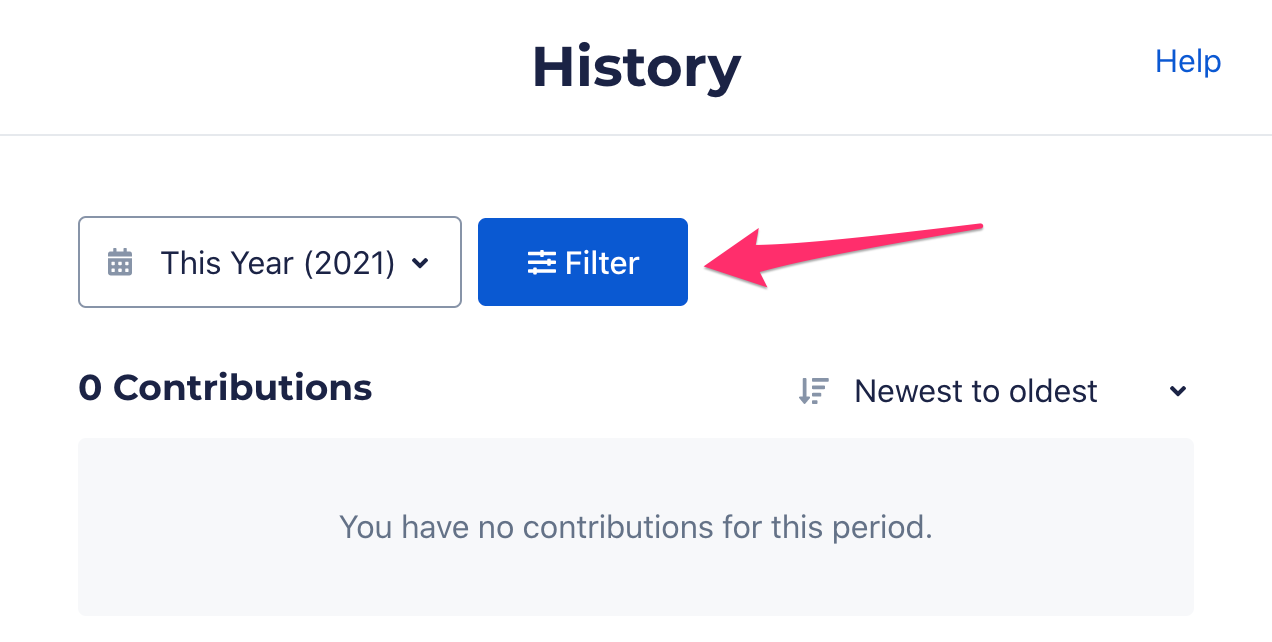

Are My Donations Tax Deductible Actblue Support

Are Political Donations Tax Deductible Credit Karma Tax

Why Political Contributions Are Not Tax Deductible

Are Campaign Contributions Tax Deductible

501c3 Tax Deductible Donation Letter Check More At Https Nationalgriefawarenessday Com 505 Donation Letter Donation Letter Template Donation Thank You Letter

Pin On Politics Current Affairs

Pin By The Project Artist On Understanding Entrepreneurship In 2022 Business Expense Understanding In A Nutshell

Are My Donations Tax Deductible Actblue Support

Do I Qualify For New 300 Tax Deduction Under The Cares Act

Explore Our Sample Of Charitable Contribution Receipt Templat Charitable Contributions Charitable Receipt Template

Are Political Contributions Tax Deductible Smart Asset

Are Your Political Contributions Tax Deductible Taxact Blog

Federal And California Political Donation Limitations Seiler Llp

How The 3 Campaign Contribution Check Box On Your Tax Form Works Marketplace